Brands that trust LawBite to provide legal services to their members

Digital legal platform for the

modern business

Law for business.

SMEs tell us it’s...

- Difficult to understand

- Takes much too long

- Full of hidden charges

Our modern approach to law means we can offer SMEs...

- Easy to use platform & app

- Low, fixed price advice

- Friendly, experienced lawyers

Simple, fast and affordable to get your legal issues sorted

- Register on LawBite platform

- Receive free 15-min consultation

- Low fees, reliable fixed prices

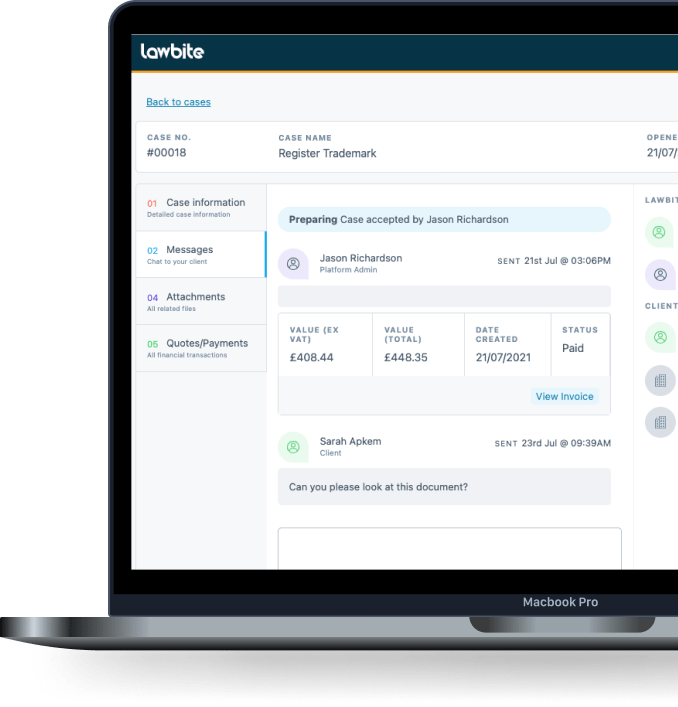

Legal expertise delivered by tech

you can rely on and trust

Business law transformed by tech

Our secure platform uses the latest on-line tools & data science to streamline client-lawyer engagement

Online solicitors safeguarding your company

Highly experienced lawyers in our own law firm (LawBriefs) that sits on the platform, regulated by the SRA

Law for SMEs at affordable prices

No hidden charges. Fixed priced work legal work using expert lawyers, but at a much lower cost

Meeting the needs of new and growing businesses

'An absolutely fantastic service'

The system allows for clear communication and feedback, I always knew what the next steps were. Both the account manager and solicitor were super accommodating and friendly. I will use this service for all of my legal matters moving forward.

Sebastian WestonSeptember 2023

'Excellent service, very slick'

The lawyer who worked on my case was very experienced, had great communication skills and picked up on some very relevant points. Would recommend!

Jonathan MatthewsJanuary 2023